I've been rather quiet, but there are good reasons to start getting excited about the possibility of something really big happening in the next couple of years.

The big news is the fact that, on the 22nd of November, 2023, a landslide majority of countries at the UN voted to begin the process of establishing a framework convention on tax and completely change how global taxes are decided. I can strongly recommend the coverage of the events by the Tax Justice Networks Podcast entitled "The day global power shifted". The proposition, made by an alliance of African countries, faced intense resistance from the OECD countries and lobbyists but nevertheless got approved. That means that the United Nations will be able to make proposals for global tax reform in a forum where measures that are supported by a majority of countries can be implemented.

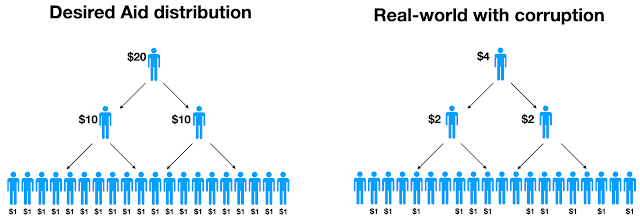

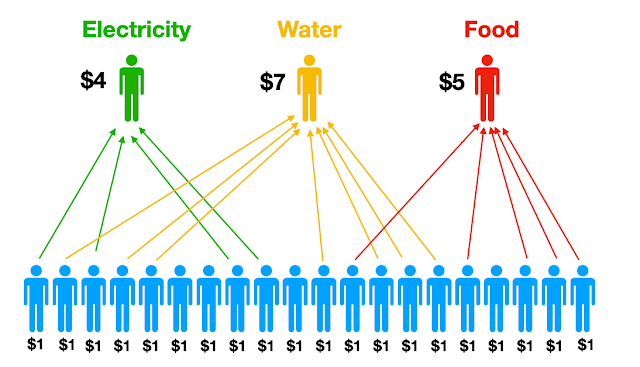

So, what sorts of reforms to the tax system could be possible in such a system. Well, many people, including the Tax Justice Network and Oxfam, have been arguing that multinational companies should be obliged to report their profits on a country-by-country basis and pay taxes to national governments that depend on the money they earn in each country. This would help prevent the current system where companies can move their profits to low tax regimes and end up paying little if any, tax. This could also be helped by ensuring a minimum level of corporate taxation for all countries.

However, I would like to explore the possibility that a UN-based tax authority could have the potential to introduce global taxes that could be used to generate the funds needed to tackle the big global challenges - and specifically the 17 sustainable development goals that all UN member states signed up to in 2015. The latest 2023 Sustainable Development Goals Report makes it clear that progress has been disappointing to put it mildly. The aim was to reach the goals by 2030. But while we are already halfway to 2030, roughly half of the 140 defined targets show moderate or serious deviations from the desired trajectory, and 30% have shown no progress or even regression compared with the situation in 2015.

One of the main reasons for the lack of progress has been the lack of funding. In a recent podcast from the Institute for New Economic Thinking, Adair Turner, the chair of the Energy Transitions Commission, noted that the shift to a net-zero carbon economy would need around $3.5 trillion a year of capital investment. African countries and countries like India have plenty of potential for generating electricity from solar panels, but lack the financial resources to install such systems. Where could they obtain the necessary funding? He talked principally about the need for investors in rich countries to play a greater role, or for organisations like the International Monetary Fund to make further loans. However, increasing debt for such countries does not seem like the best solution.

Instead, I have been suggesting that if the UN was able to impose a global wealth tax of around 0.3% per annum on all assets, it would generate the $3.5 trillion of capital investment without the need for additional debt. I was pushing this idea on my blog during the COP 28 meeting back in November. Since then, I have found some additional sources of information that are relevant to the question of how much money could be generated by a global asset tax.

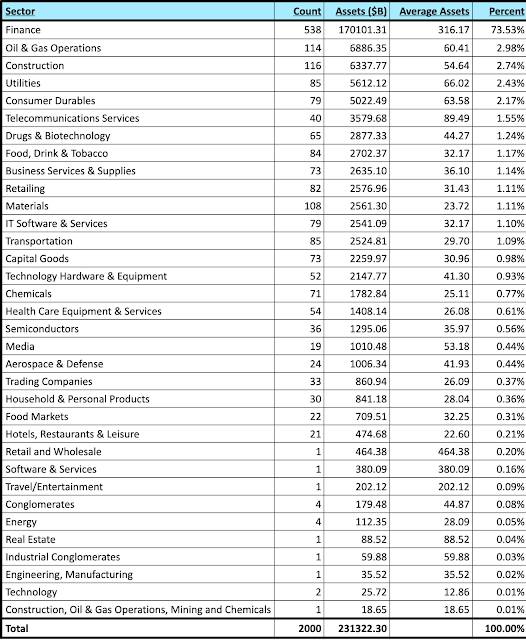

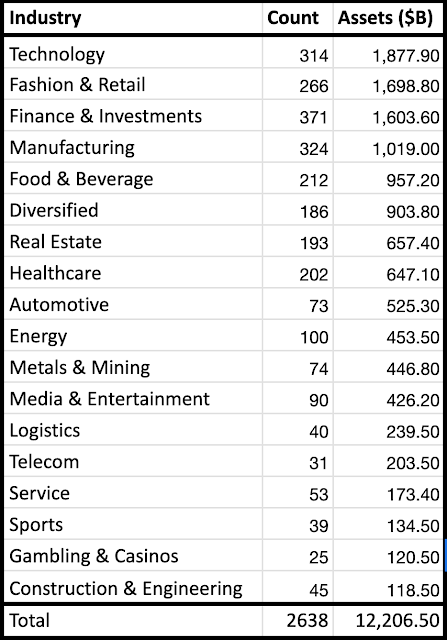

One particularly interesting source is a site that provides very complete listings for a set of 7985 publicly listed companies. They provide a range of information, including

- Market Cap - currently totalling $98.4 trillion for the 7895 companies

- Earnings - current total $7 trillion

- Revenue - current total $55.4 trillion

- Number of Employees current total 122,068,352

- Market Cap Gain,

- Operating Margin - current average 24.23%

and so forth.

But for my question, the really interesting ones are

- Total Assets - currently totalling $244.9 trillion for the 7985 companies

- Total Liabilities - current total $202.4 trillion

- Total Debt - current total $46.7 trillion

and finally

- Total Net Assets - currently $42.5 trillion

These lists, which can all be downloaded as Excel files, make for fascinating reading. Since the data includes the country of origin of all 7985 companies, it was easy for me to get the total net assets by country. Here's the list

You can see that the total number of companies is less than the 7895 figure. The reason is simple. I only included companies with positive values for net assets. There are around 400 other listed companies with negative net wealth. Top on that list is Boeing, with a net asset figure of minus $16.7 billion. Such companies would clearly not be required to pay any globally implemented tax on net assets.

But if you look at the companies with positive net assets, you can see that companies registered in the USA have total net assets worth nearly $13 trillion, with companies like Warren Buffet's Berkshire Hathaway topping the list. The next biggest players are China, which has 4 big banks close to the top of the list, followed by Japan, France, Germany and the UK.

But you can see that the dataset also includes places like the Isle of Man, the Cayman Islands, Guernsey, Jersey, Panama, the Bahamas and the British Virgin Islands. So, contrary to my expectations, it appears that it is perfectly possible to determine the net assets of companies in all sorts of locations across the planet.

It follows that if the UN Convention on Global Taxation decided to implement a 0.3% annual tax on the declared net worth of just these companies, it would generate around $131 billion of useful revenue.

From my point of view, it seems that the question of who is the ultimate owner of a company registered in the numerous UK-linked tax havens is actually irrelevant. If a company registered in the Isle of Man paid its dues, then we don't really care how many shell companies were used to protect the owners.

If desired, it might also make sense to impose a UN-administered global tax on the $55 trillion in earnings provided by the same source. But, frankly, I think that a new tax on net wealth is simpler. I have no doubt that any attempt to tax earnings would lead to companies hiring sophisticated accountants to find ways of reducing the taxable earnings figures. Hiding figures for net assets would be considerably less easy.

Once the basic wealth tax mechanism is implemented, it would become relatively simple to extend the taxation mechanisms to other companies not included on this list, including privately owned companies. Forbes provides a list of the largest US-based private companies. Unfortunately, that list only provides information about revenue and the number of employees. Those companies are also required to file their annual accounts, so it presumably would not be impossible to get the equivalent figures.

And, of course, my proposal is that exactly the same rate of tax should not just be applied to companies but to individuals - including myself! As I have already noted, the 2023 Credit Suisse Wealth Report calculated that the net wealth of the planet's 8 billion people totalled $454.4 trillion.

By taxing all net worth, it would be simple to provide the $3.5 trillion a year needed to shift to a zero-carbon economy and start tackling those 17 sustainable development goals.